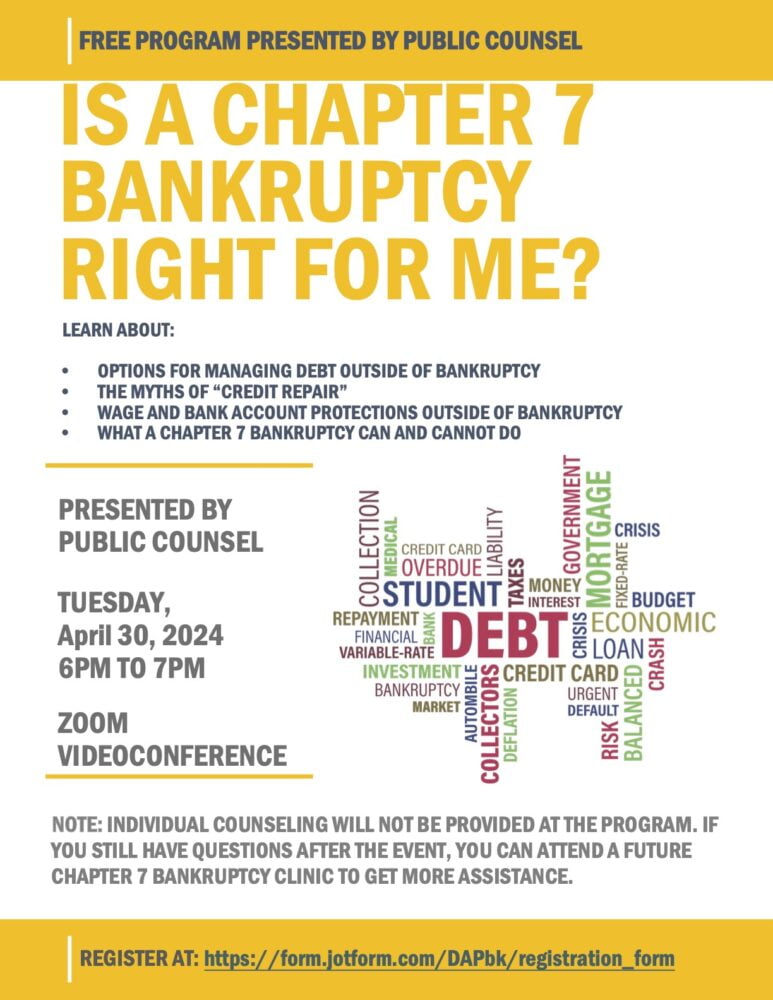

Bankruptcy

Overview

Public Counsel runs the Los Angeles Bankruptcy Clinic at the Roybal Federal Building. The Bankruptcy Clinic provides free 30-minute consultations with an attorney via Zoom or in-person (masks required) by appointment only. Appointments are required to receive a consultation. If you do not have an appointment, we cannot guarantee assistance.

We provide help with:

- Chapter 7: Counsel & advice for simple matters, referrals for complex cases

- Chapter 13: Referrals, information, limited counseling

- Creditors: Counsel & advice, referrals

- Other: Information and referrals for other legal matters and social services

Join us this Saturday, May 18th from 9am – 1pm for our Community Fest!

Learn more about bankruptcy and other legal resources/workshops

Apply for help:

(Due to the great need for our services, individuals may only sign up for one appointment at a time and may only schedule an additional appointment after their current appointment is concluded. Scheduling multiple appointments will result in the cancellation of all but one appointment. )

Or, call our phone intake line: (213) 385-2977 Ext. 704

Sponsored by Public Counsel, the Central District of California Attorney Admissions Fund, the Central District Consumer Bankruptcy Attorney Association (“CDCBAA”), and the Self-Represented Litigants Committee of the Los Angeles County Bar Association Commercial Law & Bankruptcy Section

Bankruptcy Self-Help Office

Roybal Courthouse and Federal Building

255 East Temple Street, Terrace Level Rm.100

Los Angeles, CA 90012

Map